Mr. X is a relative of borrower B (Director in this Private Ltd Company). B asks X for guarantee by keeping property and takes him to Bank (Public Sector Bank) in Jan 2013.

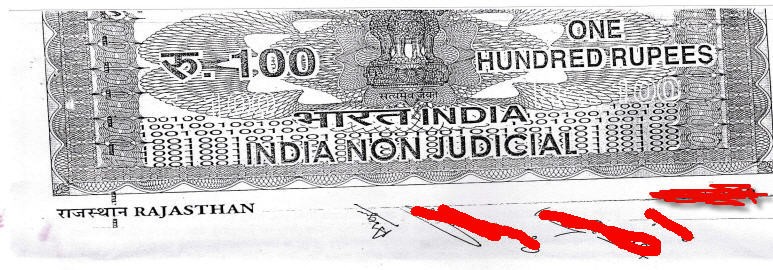

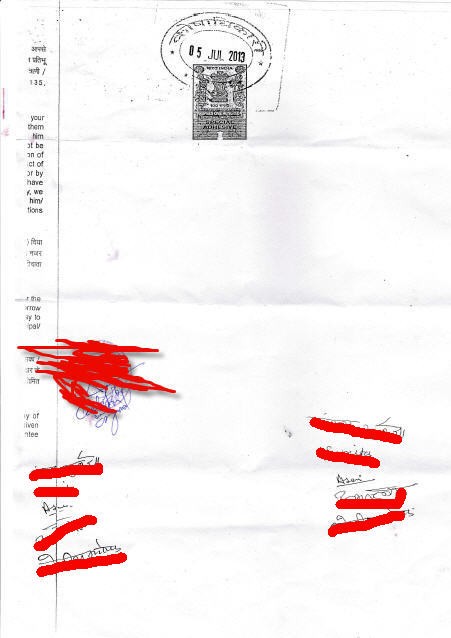

X (with B) takes the property papers to bank and X signs on Consent Letter and Sanction Letter for 50 Lacs.

B starts business and after few years i.e. 2016 goes bankrupt.

Bank starts asking X (and other stakeholders) to deposit 85+ Lacs. Notices were sent by bank.

X is surprised as to how this huge amount has been asked from him. And starts become worried about Property Papers kept in bank. Please note that no other communication with X has been done by Bank/B in past until the account got NPA.

X starts communication with bank and ask for releasing his property and willingness to pay 23 Lacs of his 46 Lacs Property. Please note that X is still under impression that valid documents were signed and bank is a keeper of Code of Conduct.

In various verbal communication with bank, X comes to know that Bank has increased Cash Credit Limit of Borrowers to 80 Lacs in July 2013 and thus 85 Lacs with interest is being asked. Properties worth 1 Crore was already with bank including other stakeholders.

Since X is aware of only one visit to bank with B, there is no communication thereafter and starts sensing something is amiss.

Bank starts verbally assuring X that signatures were taken in advance and thus 80 Lacs is what is valid for him to pay.

Various visits to bank led to procrastination from bank employees and this led X to file an RTI. First RTI was rejected as the RTI was not signed by X (lack of RTI knowledge).

Again, an RTI was filed asking for Consent Letter for 50 Lacs and 80 Lacs. Due to lack of knowledge about proper documents to be expected from bank i.e. Exact Document Name in Bank's Terminology.

RTI reply says consent letter is available for 50 Lacs. Did not find for 80 Lacs.

X approaches bank for showing the documents, though manager always used to dodge the request.

Bank continues to send 13(2) and various notices to X, making him in pressure to pay. Verbally assuring that you will be released if you pay partially.

Bank takes Symbolic Possession of Property. Also, filed a Caveat with DRT. This hit the panic button.

X agrees to pay 40 Lacs if bank releases the property papers. To this, bank ask for 45 Lacs (written documents available). Bank ties this offer with a last date as X has started asking about his documents.

X asks for his signed documents from bank (Email Conversation by help of some known starts from here), though the documents were not provided before the last date.

Finally, due to pressure of Physical Possession X gives 45 Lacs and releases property papers on last date of bank offer.

X starts pursuing the matter with Higher Authorities as the Branch seems to be rotating around the same dubious statements. X comes to know about actual documents’ name, bank take from any guarantor.

Nodal Officers were involved and bank gave documents (without stamp on Xerox copy), to X. Please note that Bank mentioned that it has provided Guarantee Deed also (written letter given).

On getting documents checked, X sees no document signed by him. X again starts asking for such documents. X sees that bank has renewed the cash credit limit in 2015 also.

This started bank stating that all documents are provided, though was not specifically replying that Deed of Guarantee was available or not.

Finally, the matter was escalated to Chairman and things started churning out with Branch started giving response in 5 Days.

Branch admitted it has no documents available with them (Guarantee Deed for 50 Lacs and 80 Lacs both). Also, it has no records of any communication done with X in past.

After this, it seems to be fraud done by Branch in providing loan to B for mutual benefits. Once B goes bankrupt and not paying back, it became a matter which will come in light to higher levels.

To cover this up, bank tried doing a recovery and closing the matter. Despite knowing that documents are not there they did a recovery from X.

X has asked Chairman his opinion on this recovery from him. Awaiting response.

Please let me know what can be done and is X liable to pay for the wrongdoings done in past between borrower and bank?

B is still working in an MNC. B's father used to manage business. Though, both have fled from city.