IN THE SUPREME COURT OF INDIA

CIVIL APPELLATE JURISDICTION

CIVIL APPEAL NOS. 4385-4386 OF 2015

SODEXO SVC INDIA PRIVATE LIMITED …..APPELLANT

VERSUS

STATE OF MAHARASHTRA & ORS. …..RESPONDENTS

J U D G M E N T

A.K. SIKRI, J.

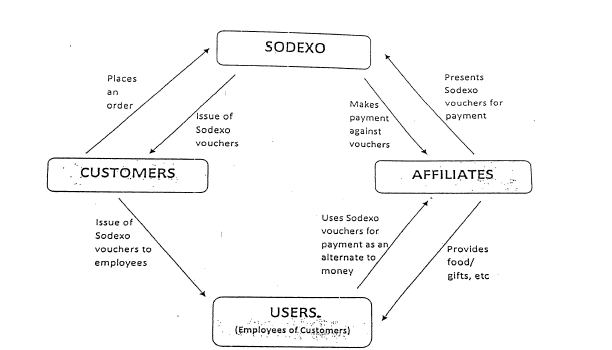

The appellant company is conducting the business of providing pre-printed meal vouchers which are given the nomenclature of 'Sodexo Meal Vouchers'. As per the appellant, it enters into contracts with its customers for issuing the said vouchers. These customers are establishments/companies having number of employees on their rolls. They provide food/ meals and other items to their employees up to a certain amount. It is for this purpose that the agreement is entered into by such establishments/companies with the appellant for issuing the said vouchers. After receiving these vouchers for a particular denomination, some are distributed by the companies to its employees. For utilisation of these vouchers by such employees, the appellant has made arrangements with various restaurants, departmental stores, shops, etc. (hereinafter referred to as 'affiliates'). From these affiliates, the employees who are issued the vouchers can procure the food and other items on presentation of the said vouchers. The affiliates, after receiving the said vouchers, present the same to the appellant and get reimbursement of the face value of those vouchers after deduction of service charge payable by the affiliates to the appellant as per their mutual arrangement. In this manner, the appellant, by issuing these vouchers to its customers, gets its service charge from the said companies. Likewise, the appellant also takes specified service charges from its affiliates. A diagramatic representation of the business model of the appellant is as under:

2) On the basis of the aforesaid arrangement made by the appellant with its customers as well as its affiliates, the question that has arisen for consideration is as to whether these vouchers can be treated as 'goods' for the purpose of levy of Octroi or Local Body Tax (LBT) or the aforesaid activity only amounts to rendering service by the appellant. The issue has to be examined as per the relevant provisions of the Maharashtra Municipal Corporation Act [Act No. LIX of 1949] under which the Municipal Corporation is entitled to levy and collect Octroi or LBT.

3) Before we advert to the relevant provisions of the Act, it would be worthwhile to mention that in order to carry on the aforesaid business, the appellant is compulsorily required to obtain necessary approval/ authorisation from the Reserve Bank of India (RBI), which requirement is spelt out from Section 7 of the Payment and Settlement Systems Act, 2007.

The appellant has been granted a Certificate of Authorisation by the RBI to operate a payment system for the issuance of Sodexo Meal Vouchers in the form of 'Paper Based Vouchers' under the aforesaid provision.

4) The Payment and Settlement Systems Act, 2007 provides for the regulation and supervision of payment systems in India and designates RBI as the authority for that purpose and all related matters. Under Section 2(1)(i) of the Payment and Settlement Systems Act, 2007, a 'payment system' is defined as a system that enables payment to be effected between a payer and a beneficiary, involving clearing, payment or settlement service or all of them but does not include a stock exchange. The appellant is also required to adhere to the Pre-paid Issuance and Operation of the Payments Instruments in India (Reserve Bank) Directions, 2009 issued under the Payment and Settlement Systems Act, 2007 and Revised Consolidated Guidelines, 2014.

Thereunder, 'pre-paid payment instruments' are defined as payment instruments that facilitate purchase of goods and services against the value stored on such installments. The value stored on such instruments represents the value paid for by the holders by ash, by debit to a bank account, or by credit card. The amount so paid by the customers is always kept in escrow account and is used strictly only for settlement of vouchers and never accounted for or used as income in the hands of the appellant. Accordingly, the Certificate issued to the appellant contains the following terms and conditions:

“The Payment System Provider shall adhere to the provisions of the Payment and Settlement Systems Act, 2007, regulations issued thereunder and the directions/guidelines issued by the Reserve Bank of India.

The authorization is only for issue of meal vouchers and gift vouchers in the form of 'Paper based vouchers' and 'Smartcard' or 'Smart Meal Card' and subject to adherence of the 'Policy Guidelines for issuance and operation of Pre-paid Payment Instruments in India' (unless specific relaxation has been permitted by the RBI)

Sodexo shall adhere to the provisions of the prevention of Money Laundering Act and ruled framed thereunder. Further, the guidelines on Know Your Customer/Anti-Money Laundering/ Combating Financing of Terrorism issued by the RBI to Banks, from time to time shall apply mutatis mutandis to the entity.”

5) Thus, as per the aforesaid authorisation by the RBI, the business operation that is carried out by the appellant, has the following essential features:

(i) the payment system operated by the appellant involves issuance of vouchers having a face value (meal and gift vouchers) to the customers;

(ii) customers grant said vouchers to their employees (beneficiaries);

(iii) the employees use the vouchers to obtain/pay for food, meal or goods;

(iv) vouchers can only be used in an affiliated network of restaurants and shops (affiliates/redeemers);

(v) the affiliated restaurant/shop having delivered the food/meal/ good, receives the voucher and turns it to the appellant who issued it for reimbursement of the face value (redemption); and

(vi) when the vouchers are redeemed, the appellant reimburses to the affiliate/redeemer the face value of the voucher and retains a service fee in order to compensate for the attractiveness of the system which has benefited to the affiliate's business. The appellant pays service tax on such service fee charged.

To read the full judgement, find the enclosed attachment