MSME: A New Definition

The distinction between manufacturing enterprises and service-oriented businesses has been removed under the new definition. The investment criteria of MSMEs have been revised up, and a new criterion for turnover has been added.

What You Need to Know About MSME Loans?

At some point, every small business needs financial assistance. Most Micro, Small, and Medium Enterprises need financial help when they grow horizontally or vertically. The need for financial assistance can be to purchase raw materials, develop infrastructure, or cover operating costs. The business can decide where to borrow the money, based on their priorities and needs.

Businesses can also borrow money from different sources. MSME business loans are unsecured business credit offered by different financial institutions. Such loans are subject to explicit eligibility criteria in order to reduce risk for lenders. The Indian government and RBI define such loans as the MSME Business Loans offered to support businesses in infrastructure, finance, and other sectors.

MSME loans are also known as SME loans (small and medium enterprises). These MSME loans are usually granted to women entrepreneurs, small business owners, and startup owners with a subjective loan term. Here are some important features, benefits, and eligibility of msme loans online.

SME/MSME Business Loan: Features

MSME loans online can provide funds for many important functions that are crucial to the growth of a business. They can, for example, save time by filling out an online form and confirming the requirements. Digital platforms do not require them to follow a lengthy approval process.

Key Features Offered by Digital Lending Platforms:

- Online Application: Digital lenders use a rapid approval procedure to reduce the time it takes for MSME loans online.Online loans are usually approved in a matter of days if the eligibility criteria are met.

- The Amount and Duration of the MSME Loan: A MSME loan can be obtained up to ₹50 lakhs. The majority of digital lending platforms are flexible when it comes to repayment. The duration of the loan is usually between 12 and 36 months to allow businesses to pay it back according to their schedule.

- Hidden Charges: Digital lenders offer MSME loans online without any hidden fees or charges.

- Flexible Repayment Option: The digital lenders provide a wide range of repayment options and timeframes to their MSME/SME clients. The MSME loan tenure ranges up to 36 months.

Interest Rates and Fees for SME/MSME Loans

- Customized Interest Rates: Starting at 1% PM

- Processing Fees: ~4%

- Loan Tenure: Maximum 36 months

- Pre-closure Charges: 5%

Benefits of MSME Business Loan

What are the advantages of applying for a MSME business loan from a digital lender?

- Competitive Interest Rates: Online MSME loans offer competitive rates of interest. Digital lenders use an online loan application that saves both time and resources. This helps them to save costs and offer competitive interest rates to MSMEs.

- No Collateral: MSME loans are unsecured. SME loans do not require collateral.

- Quick Funding: MSME loans can be approved within a few days. The fund disbursement will be made at a fast rate. What else can they expect? MSME loans can be approved in a matter of days, not weeks.

- Complete Control: MSME loans are unsecured for applicants who meet certain criteria. They retain ownership and control of their assets. These assets can be used to expand their business.

- Better Capital Management: Digital lenders offer MSME loans online without collateral to applicants who want peace of mind. The funds can be used to invest in machinery and plant or to streamline cash flow and working capital.

- Increase Goodwill: To grow and succeed, every business requires the right kind of boost. SME loans are the ideal medium to help these enterprises grow when the time is right. It will improve their reputation and goodwill on the market. This will increase the number of avenues available for investment and business financing.

MSME Loan Eligibility Criteria

Digital lending platforms do not believe in burdening loan applicants with complicated eligibility criteria. Businesses are generally eligible for a loan if they meet the following criteria:

- The manufacturing unit has been operational for one year.

- The last year's IT returns were filed on time.

- The GST returns for the past six months are filed on time.

How to Apply for MSME Loans Online?

Get an MSME/SME Loan in 3 Easy Steps:

1. Application: Applicants who wish to secure an MSME loan can fill in an online application form giving details about their fund requirements.

2. Documents: The next step is to upload relevant documents like bank statements, PAN card copy, Aadhaar card copy, Business Registration Certificate, GST Filing, Drug License, Trade License, TIN, and VAT Registration.

3. Sanction: All documents and other submissions will be verified before a loan request can be approved.

Why Should Enterprises Consider an MSME Business Loan?

The MSME sector in India is the leading source of employment and industrial output. This sector accounts for around 40% of India's total exports and 45% of its total industrial production. The MSME sector is always in high demand for financing.

The inability to obtain finance at the appropriate time is a major problem for many small and medium-sized enterprises. Non-Banking Financial Companies (NBFCs) are a promising option for manufacturers who need to get business financing immediately. Online submissions have been made for MSME loans.

There are many ways you can use the money from a business standpoint:

- Plant and Machinery

- Purchase of Raw Materials

- Working Capital Management

- Marketing

- Manpower

MSME Loan Calculator

How to Use MSME Loan Calculator?

The standard formula is used by most online businesses to calculate EMIs. To use any standard online calculator, you'll need to enter the following values:

- Principal amount

- Interest rate

- Tenure

Imagine you borrowed ₹5 lakhs at an annual interest rate of 12% for 24 months. Online business loan calculators allow you to calculate your monthly EMI and the total amount that you'll be paying.

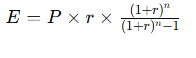

Formula to Calculate MSME Loan EMI:

Conclusion

MSME loans online can be calculated in many different ways. Don't forget to calculate the EMI every month when you borrow money to fund your startup or small business. This will allow you to make more informed financial decisions. MSME Loan Calculator makes it easy to calculate your loan.

Join LAWyersClubIndia's network for daily News Updates, Judgment Summaries, Articles, Forum Threads, Online Law Courses, and MUCH MORE!!"

Tags :Others