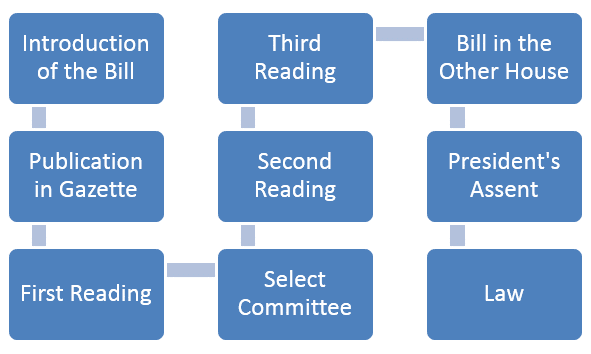

The basic function of Parliament is to make laws, amend them or repeal them.Legislative Procedure refers to the procedure which is followed for making laws. It is initiated by the introduction of proposal for the legislation in the form of a bill and involves the following stages broadly:

- Introduction of the bills in one of the houses.

- When it is passed in that house, the bill is transmitted to the other house.

- When the bill is passed or deemed to have been passed by both the houses, it is sent to the President for his assent thereto. On his assent the bill becomes law and legislative procedure completes.

This article discusses the legislative process in respect to the following bills:

- Ordinary Bill

- Money Bill

- Financial Bill

- Bill involving expenditure from Consolidated Fund of India

ORDINARY BILL (Article 107)

Ordinary bills are concerned with any matter other than Financial Bills, money Bills or bill involving expenditure from Consolidated Fund of India.

An ordinary bill may be introduced in either houses of Parliament, when passes by the house in which it is introduced, the bill is to be transmitted to the other house. When the other house also agrees to the bill, it is said to have been passed by both the houses, It is then sent to the President for assent.

A bill is carried forward through all the stages of the legislative process “by a long chain of standardized motions” which must be adopted by the House before the bill becomes law. It is these motions, and not the bill, that are the subject of the decisions and debates of the House. These stages “constitute a simple and logical process in which each stage transcends the one immediately before it, so that although the basic motions — that the bill be read a first (second or third) time — ostensibly are the same, and seem repetitious, they have very different meanings”. The passing of the bill is done in three stages commonly known as readings:

First Reading- the bill is just introduced. No discussion takes place at this stage.

Second Reading- Consideration stage begins where the bill is discussed clause by clause. At this stage amendments are moved, or accepted or rejected.

Third Reading- A brief general discussion takes place and the bill is passed.

All the three readings takes place in both the houses.

MONEY BILL (Article 110)

The expression ‘Money Bill’ is defined by clause (1) of Article 110. It is that bill which contains only provisions dealing with all or any of the following matters, namely-

- The imposition, abolition, remissions, alteration, or regulation of any tax.

- The regulation of the borrowing of money or guarantee by the government of India, or the amendment of the law with respect to any financial obligations undertaken or to be undertaken by the Government of India.

- The custody of the Consolidated Fund of India or the Contingency Fund of India, payments of moneys into or withdrawal of moneys from any such fund.

- The appropriation of money out of Consolidated fund of India.

- The declaring of any expenditure to be the expenditure charged on the Consolidated Fund of India or the increasing of the amount of any such expenditure.

- The receipt of money on account of the Consolidated Fund of India or public account of India or the custody or issue of such money or the audit of the accounts of the Union or of a State.

- Any matter incidental to any of the matters specified in sub clause (a) to (f).

However, a bill shall not to be deemed a Money Bill by reasons only that it provides for the imposition of the fines or pecuniary penalties or for demand or payment of fees or it has anything to do with tax.

If any question arises as to whether a Bill is a money bill or not, the decision of the Speaker of LokSabha shall be final.

Special procedure in respect of Money Bills (Article 109)

- A Money Bill shall not be introduced in the Council of States

- After a Money Bill has been passed by the House of the People it shall be transmitted to the Council of States for its recommendations and the Council of States shall within a period of fourteen days from the date of its receipt of the Bill return the Bill to the house of the People with its recommendations and the House of the People may thereupon either accept or reject all or any of the recommendations of the Council of States

- If the House of the People accepts any of the recommendations of the council of States, the Money Bill shall be deemed to have been passed by both Houses with the amendments recommended by the council of States and accepted by the House of the People

- If the House of the People does not accept any of the recommendations of the council of States, the Money Bill shall be deemed to have been passed by both Houses in the form in which it was passed by the House of the People without any of the amendments recommended by the Council of States

- If a Money Bill passed by the House of the People and transmitted to the council of States for its recommendations is not returned to the House of the People within the said period of fourteen days, it shall be deemed to have been passed by both Houses at the expiration of the said period in the form in which it was passed by the House of the People

It is thus clear that RajyaSabha has no power with respect to the passing of a Money Bill except delaying its passing for a period of 14 days.

FINANCIAL BILL (Article 110)

As per Article 110 of the Constitution of India, the Finance Bill is a Money Bill. The Finance Bill is a part of the Union Budget, stipulating all the legal amendments required for the changes in taxation proposed by the Finance Minister.

This Bill encompasses all amendments required in various laws pertaining to tax, in accordance with the tax proposals made in the Union Budget. The Finance Bill, as a Money Bill, needs to be passed by the LokSabha — the lower house of the Parliament. Post the LokSabha’s approval, the Finance Bill becomes Finance Act.

Difference between a Money Bill and the Finance Bill

- A Money Bill has to be introduced in the LokSabha as per Section 110 of the Constitution. Then, it is transmitted to the RajyaSabha for its recommendations. The RajyaSabha has to return the Bill with recommendations in 14 days. However, the LokSabha can reject all or some of the recommendations.

- In the case of a Finance Bill, Article 117 of the Constitution categorically lays down that a Bill pertaining to sub-clauses (a) to (f) of clause (1) shall not be introduced or moved except with the President’s recommendation.Also, a Bill that makes such provisions shall not be introduced in the RajyaSabha

A BILL INVOLVING EXPENDITURE FROM THE CONSOLIDATED FUND OF INDIA (Article 117 (3))

A Bill which, if enacted and brought into operation, would involve expenditure from the consolidated Fund of India shall not be passed by either House of Parliament unless the President has recommended to that House the consideration of the Bill.

DEADLOCK IN THE HOUSES OF PARLIAMENT ON A BILL (Article 108)

Joint sitting of both Houses in certain cases where the bill is not a Money Bill.

- If after a Bill has been passed by one House and transmitted to the other House

- the Bill is rejected by the other House; or

- the Houses have finally disagreed as to the amendments to be made in the Bill; or

- more than six months elapse from the date of the reception of the Bill by the other House without the Bill being passed by it the President may, unless the Bill has lapsed by reason of a dissolution of the House of the People, notify to the Houses by message if they are sitting or by public notification if they are not sitting, his intention to summon them to meet in a joint sitting for the purpose of deliberating and voting on the Bill: Provided that nothing in this clause shall apply to a Money Bill

- In reckoning any such period of six months as is referred to in clause ( 1 ), no account shall be taken of any period during which the House referred to in sub clause (c) of that clause is prorogued or adjourned for more than four consecutive days

- Where the President has under clause ( 1 ) notified his intention of summoning the Houses to meet in a joint sitting, neither House shall proceed further with the Bill, but the President may at any time after the date of his notification summon the Houses to meet in a joint sitting for the purpose specified in the notification and, if he does so, the Houses shall meet accordingly

- If at the joint sitting of the two Houses the Bill, with such amendments, if any, as are agreed to in joint siting, is passed by a majority of the total number of members of both Houses present and voting, it shall be deemed for the purposes of this Constitution to have been passed by both Houses: Provided that a joint sitting

- if the Bill, having been passed by one House, has not been passed by the other House with amendments and returned to the House in which it originated, no amendment shall be proposed to the Bill other than such amendments (if any) as are made necessary by the delay in the passage of the Bill;

- if the Bill has been so passed and returned, only such amendments as aforesaid shall be proposed to the Bill and such other amendments as are relevant to the matters with respect to which the Houses have not agreed; and the decision of the person presiding as to the amendments which are admissible under this clause shall be final

- A joint sitting may be held under this article and a Bill passed thereat, notwithstanding that a dissolution of the House of the People has intervened since the President notified his intention to summon the Houses to meet therein

Join LAWyersClubIndia's network for daily News Updates, Judgment Summaries, Articles, Forum Threads, Online Law Courses, and MUCH MORE!!"

Tags :Others