India Inc lauds FM for good Budget; regrets MAT hike

Indian industry has welcomed the Union Budget for 2010-11 saying it was a balanced approach though it expressed disappointment over the hike in minimum alternate tax (MAT) from 15 per cent to 18 per cent.

The captains of the industry lauded the concessions given to individual and corporate tax payers, saying Mukherjee had done a "good" job.

"The Finance Minister has done a good in balancing job... He has been able to contain the fiscal deficit at 6.9 per cent, which is very good," said Harshpati Singhania, President of apex chamber Ficci.

"However, there is a big surprise and disappointment on MAT. Decrease in surcharge would be eaten by increase in the MAT rate," Singhania added.

CII President Venu Srinivasan said: "It is a very balanced and responsible budget. The growth will continue with this Budget. The changes in Income Tax slabs are a welcome step."

He also complimented the Finance Minister for calibrated roll back of stimulus measures, which is how the industry had wanted it.

"The only dark spot is increase in MAT."

Bharti Enterprises Vice Chairman Rajan Mittal and president elect FICCI said, "We would have been much happier if the MAT have not been increased. While reduction on surcharge is welcome, increase in MAT is a disappointment,"

Mittal, however, said the Budget is growth oriented and "good part is that he has shown the road map for the implementation of GST (Goods and Services Tax)."

FIEO President A Sakthivel welcomed the extension of concessional export finance regime till 31st March, 2011, but expressed disappointment on exclusion of some of the labour intensive sectors.

"Exclusion of textiles, leather, marine and gems and jewellery will add to the woes of these sectors as some are still showing decline while other exhibited growth on very low base," Sakthivel said.

Infosys Human Resource Director Mohandas Pai said hike in MAT will not impact large companies, though smaller IT companies will be hit.

"The country has lost thousands of jobs in IT industry. So, it's disappointing for IT industry," Pai said.

Meanwhile, Infosys CEO Kris Gopalkrishanan said that the move

will not impact the company.

Kotak Mahindra Bank Vice Chairman Uday Kotak said the Finance Minister had played a balancing act of trying to get all the concerned actors on board for the GST.

"It will be credible if the GST could be brought in by April 2011," Kotak said.

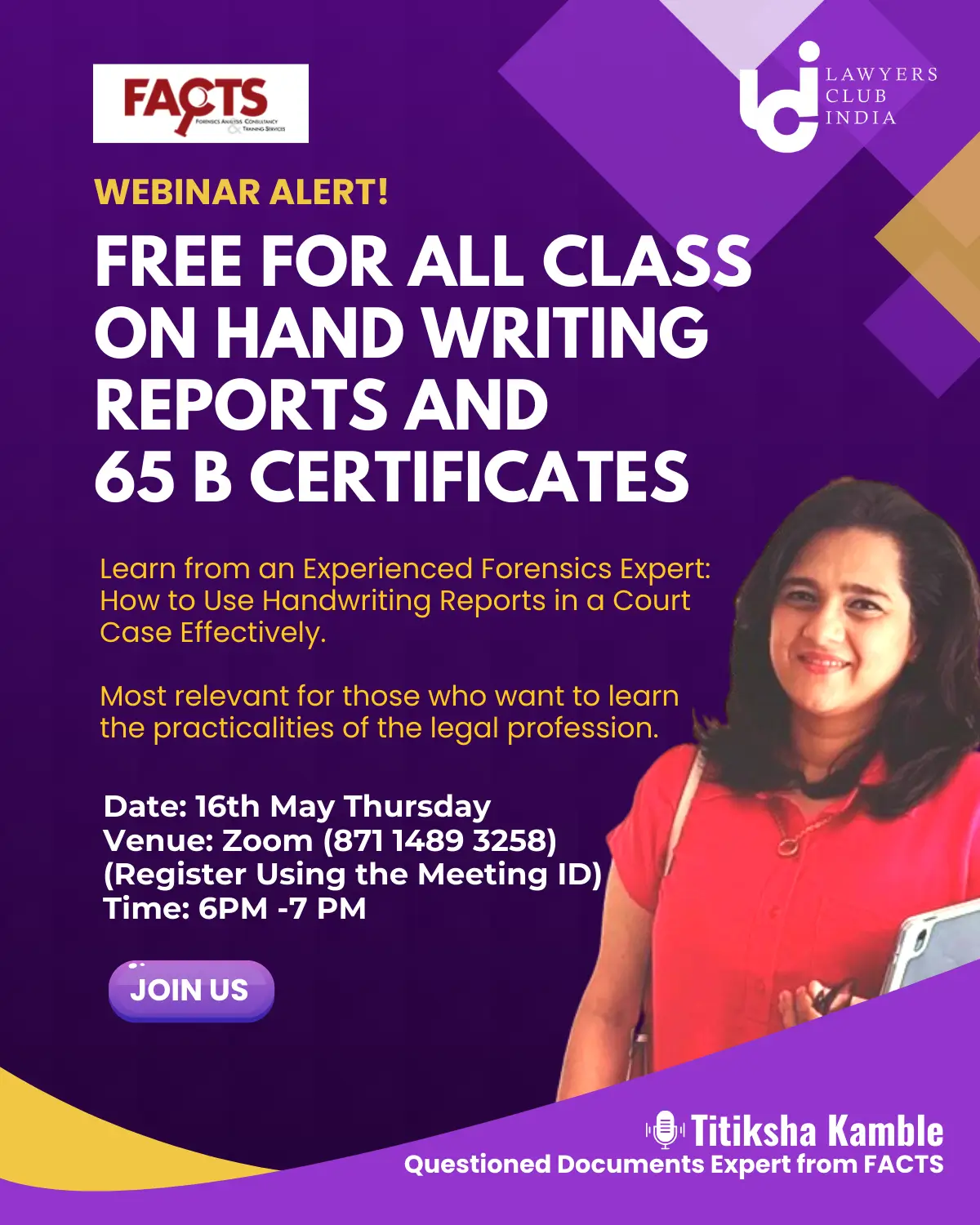

Join LAWyersClubIndia's network for daily News Updates, Judgment Summaries, Articles, Forum Threads, Online Law Courses, and MUCH MORE!!"