Goods and Services Tax (GST) is now applicable to all goods and services transactions happening throughout the nation. This tax replaces the multitude of indirect taxes levied on goods, transport, and financial services across the country and states. While it has simplified indirect tax collection for the government and taxpayer, it impacts is yet to be fully understood.

What is GST?

GST is an indirect tax based on the destination of sale and value-added to the product or service. Unlike, earlier taxes which were multi-stage and created a problem of double taxation, GST is applicable only when a product or service is sold or provided.

The rate of GST depends on the type of service or product. A list of rates applicable under GST on different goods and services can be found here.

|

Old Central Taxes |

Old State Taxes |

|

Excise duty |

Value added tax (VAT) |

|

Service tax |

Entry tax and octroy |

|

Central surcharges and cess |

Luxury tax |

|

Special additional custom duty |

Purchase tax |

|

Additional customs duty or Countervailing Duty (CVD) |

Taxes on thelottery, gambling, etc. State surcharges and cess |

Table: GST Supersedes Multiple Taxes

How does It Affect Loans?

The applicable rate for financial services under GST regime is 18%. That means all the charges levied by the lender will be taxed at 18%. This was earlier service tax at 15%, thus your installments and financier’s fee increases slightly under GST.

Let’s see how your payments change under GST:

|

Business Loan |

Old Tax Regime |

GST Regime |

|

Loan Amount |

1 Crore |

1 Crore |

|

Processing Charges @ 0.25% |

25,000 |

25,000 |

|

Service Tax/GST |

15% |

18% |

|

Total Processing Fees Paid |

28,750 |

29,500 |

|

Prepayment Penalty |

3% |

3% |

|

Prepayment Charges |

75,000 |

75,000 |

|

Service Tax/GST |

15% |

18% |

|

Total Prepayment Charge Payable |

86,250 |

88,500 |

Table: GST effect on Your Business Loan

Should You Worry?

The effect of GST might seem to make the business loan application a bit expensive, however, it’s overall effect is simplifying the indirect tax regime.Thus, if your business activity falls under GST, you can breathe easy as you will only need to file one indirect tax instead of multiple taxes.

Also, if you are selling goods in another state, you will be filing only one return for the GST collected from the sale in the other state. Unlike the earlier tax payments at multiple stages, anindirect tax on interstate sale is collected by the Central Authority and later credited to the state where it is due. So, the sellers can take it easy about paying multiple excise duties and VAT charges.

Here’s how GST simplifies the indirect tax for your business:

There are three types of GST applicable, based on the transaction type and location (of sale):

CGST (Central GST): Tax collected by the central government

SGST (State GST): Tax collected by the state governments for sale within the state

IGST (Integrated GST): Tax collected by the central government for inter-state sales (goods manufactured in one state sold in another)

|

Transaction |

Old Regime |

New Regime |

Comments |

|

Intra-state |

VAT + Central Excise/Service tax |

CGST + SGST |

Revenue shared between the Centre and the State |

|

Inter-state |

Central Sales Tax + Excise/Service Tax |

IGST |

Only central tax payable for inter-state sales |

Table: Change of tax structure

Input Credit Applicable

While the tax rate may seem high, the final tax incidence on the consumer is lower. Also, the effort and complexity faced by businesses in adhering to multiple tax laws have reduced under GST. Thus, even the slight increase in financial services fee will not bite the business cash flows.

Also, the manufacturers, retailers, etc. get the credit for the tax paid on the input material they buy. This credit can reduce the tax incidence while filing the collected GST on thesale of goods.

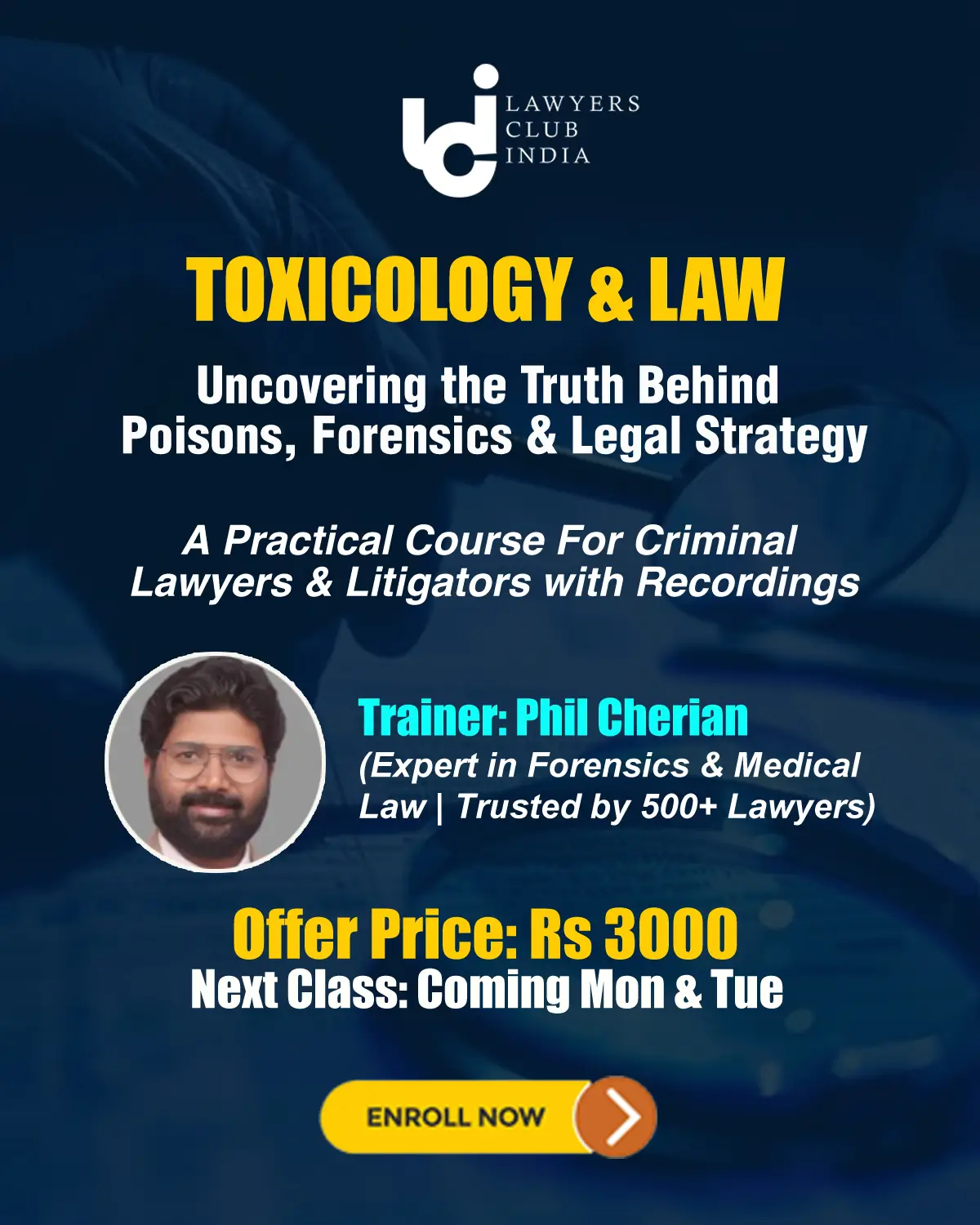

Join LAWyersClubIndia's network for daily News Updates, Judgment Summaries, Articles, Forum Threads, Online Law Courses, and MUCH MORE!!"

Tags :Taxation