For the first time in 92 years, the Railway budget was presented along with the Union Budget on 1st Feb. This year’s budget was also different as it was followed by the demonetisation move by Prime MinisterMr. Narendra Modi on 8th November, which made Rs 500 and Rs 1,000 currency notes invalid. Some key announcements were made, particularly on taxes and finance.

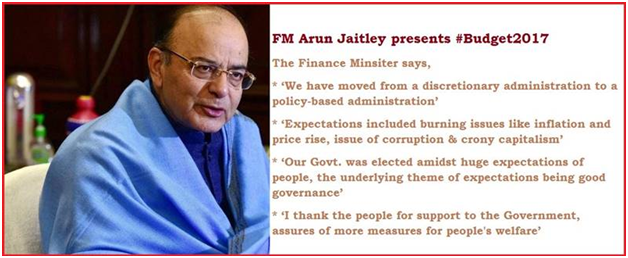

A quick glance as to the announcements made by the finance minister about the finance sector.

Source: financialexpress.com

- Current tax rate for individuals earning between Rs 2.5 lakhs and Rs5 lakhs is cut from 10% to 5%. However, in case of very senior citizens, no change in tax slab

- All other categories of taxpayers will get the subsequent tax benefit of Rs 12,500

- Tax rebate under Section 87A is reduced from Rs 5,000 to Rs 2,500

- No tax rebate for taxpayers earning over Rs 3.5 lakhs

- From Assessment Year, 2018-19, no tax deduction will be given for making an investment in Rajiv Gandhi Equity Saving Scheme

- With effect from 1stApril 2017, Income tax officials can reopen tax cases which are over ten years old if during search operations revealed an undisclosed income and asset of more than Rs 50 lakhs

- Long-term capital gain tax on immovable property will apply after 2 years instead of 3 years. Further, the tax will be levied on unoccupied houses only after obtaining completion certificate

- Cash transaction above Rs 3 lakhs is prohibited

- 10% surcharge on people earning between Rs 50 lakhs and Rs 1 crore. Also, 15% surcharge on Rs 1 crore income or more will remain same

- Income tax return form has been simplified. There will be a single one-page form for filing IT returns for non-business income below Rs 5 lakhs

- Those filing income tax returns for the first time will not be scrutinized by the government

- Those taxpayers who fail to file their tax returns on time will have to pay a penalty of up to Rs 10,000 from Assessment year 2018-19 if their total annual income is more than Rs 5 lakhs. If it is below Rs 5 lakhs, the fee payable under the section doesn’t exceed Rs 1,000

- With effect from 1stJune 2017, individuals will require deducting a 5% TDS (tax deducted at source) if rental payments are more than Rs 50,000/month

- Any partial withdrawal from National Pension System (NPS) will not attract tax. It means, an NPS subscriber can withdraw 25% of his/her contribution before retirement

- More Aadhar-based Point of Sale terminals will be set up. The shift to digital platform will offer enormous benefits to a common man

- The government will issue Aadhar smart cards with health details to senior citizens. Also, the government will work Life Insurance Corporation to launch a scheme for senior citizens with 8% return on the annuity

- Tenure of revising tax returns is reduced to 12 months

- Cash donation limit for charities is limited to Rs 2,000

A quick look at the new Income Tax Slab for the Financial Year 2017-18

|

Individuals below 60-year |

|

|

Income |

Tax Slab Rate |

|

Up to Rs 2,50,000 |

Nil |

|

Rs 2,50,001 to 5,00,000 |

5% |

|

Rs 5,00,001 to 10,00,000 |

20% |

|

Above Rs 10,00,000 |

30% |

|

Senior Citizens (aged 60 but below 80 years) |

|

|

Income |

Tax Slab Rate |

|

Up to Rs 3,00,000 |

No Tax |

|

Rs 3,00,001 to Rs 5,00,000 |

5% |

|

Rs 5,00,001 to Rs 10,00,000 |

20% |

|

More than Rs 10,00,000 |

30% |

|

Very Senior Citizens (Aged 80 years and above) |

|

|

Income |

Tax Slab Rate |

|

Up to Rs 5,00,000 |

No Tax |

|

Rs 5,00,001 to Rs 10,00,000 |

20% |

|

More than Rs 10,00,000 |

30% |

Union Budget and the insurance sector

The Budget 2017 was focused to transform, energise and clean India (TEC India). The government unveiled 10 different sub-sections to revolutionize various sectors in India, as well as to empower and energise youth and women in India. However, in the aftermath of the demonetisation, expectations were high, but not all of them were fulfilled, especially on the insurance side.

If we talk about the insurance sector, the government offered very little. As the life insurance penetration in India is close to 3.4%, a few sops would have helped in bolstering the social security. Though the government has done a commendable job by providing some relief to people falling into the lower income tax slab, it could have been boosted with some rise in the health insurance tax exemption limit.

However, the general insurance sector hails the government’s decision to expand the coverage under the Pradhan Mantri Fasal Bima Yojana from 30% to 40% in 2017-18 and 50% in 2018-19.

If the rural sector enjoys a stable income, growth can be witnessed in the life insurance sector as well. Usually, rural people stay away from buying insurance policies as they do not know whether they would be able to pay premiums or not. As a result, their policies lapse, but PMFBY will ensure the persistence of policies in all circumstances.

Though the Finance Minister’s move to give 8% returns to senior citizens is a good move; no announcement was made to encourage the younger population to build a retirement nest egg. Undeniably, insurance and pension sectors requires some shift in perception and a little encouragement by the government, in the form of sops, would have done wonders.

Further, the budget has cut the holding period required to get capital gain tax exemption in real estate to two years. As a consequence, people will be able to shift their investable surplus from physical assets to financial assets. Also, the budget has made provisions to popularize the Digital India initiative in the country. By resorting to the online mode, customers can enjoy transparent and cost-effective services.

Overall, all the above announcements are looking promising on papers; only the time will tell their real impact.

Join LAWyersClubIndia's network for daily News Updates, Judgment Summaries, Articles, Forum Threads, Online Law Courses, and MUCH MORE!!"

Tags :Others