Introduction: For generations have believed that the sole purpose of finding work, doing work and achieving the desired objective in the work we do is to earn livelihood (money). At least that’s what applies to most of us, blatantly excluding the elite. However, the question remains have we ever tried to understand; what money is and really means? Nobel laureate John R. Hicks declared, ‘is defined by its functions...money is what money does’.

I do not wish to delve into the various economic theories, to understand, and try to define money & its function myself. I only wish to make an enquiry from layman’s point of view on the source, function & purpose of money in the modern day context.

1. History of Money: If money is to be understood as “money is what money does” as mentioned above, then the question which should hammer all of is, why is there a rise in cost of goods and services that we depend upon on daily basis, making those goods and services unaffordable for many? Meaning for example why what a Rs. 10 note cannot get you the same thing today, but could easily get that thing for our fathers or grandfather’s generation. Has the Rs. 10 note changed, maybe in colour and size, but does the issuing authority not remain the same?

Money on contrary can be anything (even fiat currency notes made of paper having the backing of the government) which could be used as a medium of exchange, which has value, which can never be a liability in our wildest imagination, which can be divided in smaller denominations, which never loses its value i.e., never reduces in its purchasing power. Unfortunately we do not experience the aforementioned with our modern day fiat currency notes, which are losing value faster than speed of light. An example would be the ever increasing cost of the fuel thereby directly affecting the transportation cost and the price of consumer goods.

Looking back into history we find that most of the kingdoms issued and used gold and silver as their currency. Once they started to mix gold and silver coins with metals of lesser value they were struck by hyperinflation followed by a deflationary spiral which led to a complete destruction of their kingdoms.

The Bretton Woods Agreement of 1944 was one of the bench marks in the history of money where the United States Dollar (USD $), a fiat currency, made of paper was made the reserve currency of the world. What it essentially meant was that all the currencies in the world would be pegged to the $ and the $ would be backed by gold at 35 dollars per ounce. Thus every currency which agreed to be pegged against the $ gained the confidence required for a fiat currency to survive, as the $ was backed by gold (gold standard). The currency markets (manipulated in my opinion) that we hear about today would be non-existent if the system would be continued.

On 15th August 1971 Richard Nixon was forced to remove the gold standard because the Federal Reserve Bank of United States of America had fraudulently printed more currency notes than the amount of gold it had. It is pertinent to note here that Federal Reserve Bank of United States of America is a private corporation under the control of private bankers and not a constitutional body under the control of the elected representatives (shocked do your own research if you do not believe).

2. Debt Based Economic Model: One of the main things that we do not realize which affects us is the concept of borrowing money. We borrow money from an unknown future with a promise or an undertaking to repay the same with agreed interest. So when we borrow we bring into existence cheap money, .i.e, money either brought into existence by mad excessive printing or by typing in a desired number on the computer screen. The more people borrow the more easy money (currency) is brought into existence. The most unfortunate aspect of this model is that we believe that the bank’s loan out a part of money that they have in their deposits, but that’s not true, banks use a technique known as “Fractional Reserve Banking” system to provide loans to their customers. Unfortunately it results in increase of cheap money supply which is a main cause of inflation (rising prices) which slowly bleeds out the middle class. The perfect example of what happens when there is an inability to repay loans with the interest is the Great Recession of 2007-2008, crash of Lehman Brothers-Freddie Mac-Fannie Mae.

For some Adam Smith who is the father of modern day banking (The Credit Theory) failed to understand and correctly define money.

3. Bail In’s and Bail Outs: When people borrow and are unable to repay, such loans are termed as bad loans or NPA’s or by whatever name. What do you think will be the effect on the banks if all those who have borrowed are unable to repay? The result is obvious the banks that lent would go bankrupt. The recent example would be of what happened in Cyprus where the banks were forced to remain shut and controls were imposed on how much one could withdraw from the banks or from the ATM’s. However, at times the governments chip in by lending money (by printing more and more easy money) and bail out such bankrupt banks. On the contrary what happened in Cyprus was exactly the opposite, where the government decided to take the money from the tax payer’s deposits, a bail in, to help bail out, bankrupt banks. You would be mistaken if you believe that the same will not happen anywhere else or that we are immune to such bankruptcies.

4. Currency Depreciation: Have you ever wondered why the INR is getting depreciated (losing its value)? As discussed earlier the world reserve status of the $ and about the privately owned bank i.e., the Federal Reserve Bank and modern day banking system based on credit, which can be blamed for not only the plight of the INR but also the increasing poverty and the suffering that we see in the form of rising prices etc. The Federal Reserve embarked on a novel scheme known as Quantitative Easing which essentially means keeping the interest rates low (robbing the depositors) and flooding the markets with easy money by printing (debt based sewer). But the most unfortunate aspect of this novel scheme has been that all the money that has been printed has been held by Federal Reserve Bank and on which the Banks have been earning interest, thereby, denying the genuine borrower an opportunity have access to it.

Now there are rumors that there is every possibility of the Federal Reserve Bank would taper, which essentially means it will stop printing the un-backed worthless paper currency notes. As the $ is the world reserve currency most of the investors are running out of emerging markets and taking positions with the $, which is having a direct impact on the currencies of not only the emerging market economies but every other nation that has pegged its currency against the $.

5. A possible solution: If anyone believes that the currency notes one has with him/her is money is mistaken. Why? Because money is an asset that never loses it value. For example if 10 grams of gold could get you 1 barrel of oil in 1950, the same amount of gold can get you a high quality well knit suit today. Why? Because the natural resources that mother earth has given us are not infinite and as a result of which the cost of production of oil has gone up since 1950.

So what would be a possible solution to this debt ridden economic model? What could be a possible solution to protect one from currency debasement, deflation, inflation, stagflation, hyper-inflation, recession and depression?

I am not an expert but here is what I think should be done:-

a. Dump the $ and its reserve currency status,

b. Educate people about true definition of what money really is,

c. If we decide to use worthless paper currency as money, print only that much that is required,

d. Completely get rid of the interest that requires to be paid,

e. Have a community based approach where the paper currency is printed to benefit the community at large,

f. Back fiat currencies with a tangible asset i.e., gold and silver, meaning the currency notes one has can be exchanged with certain agreed amount of gold or silver with the banks, or

g. Or get completely rid of paper money and start using gold and silver to make the payments (maybe sounds a bit harsh). But imagine if all of us got into circulation whatever amount of gold we had, this debt driven economy we live in will slowly die, no one will be poor, there will be no interest payments required to be made, banks would become more accountable to their customers, no more bail in’s or bail outs would be required etc.

“Unchained slavery that we all are subject to today will disappear only if we took the pain to understand what money really is”

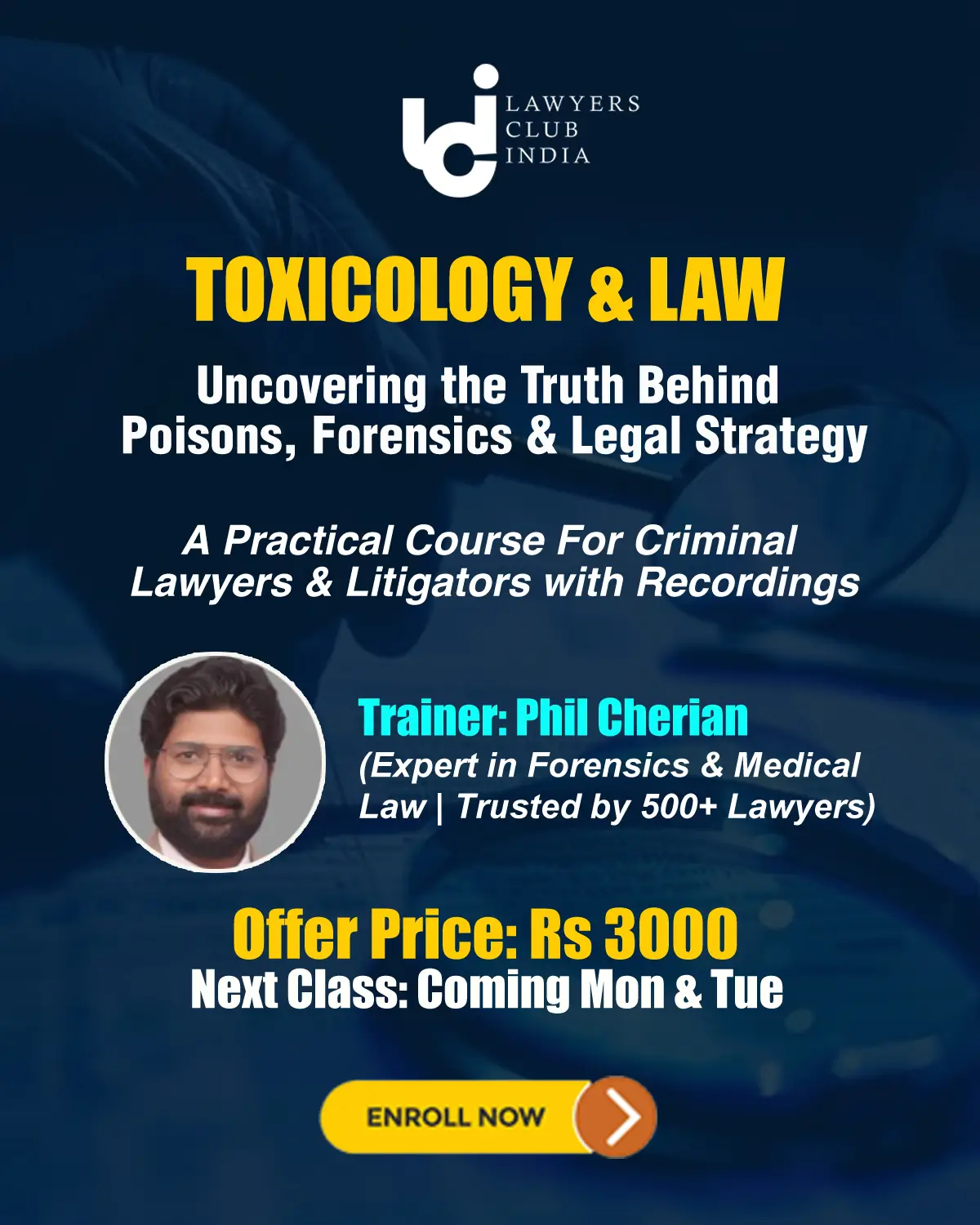

Join LAWyersClubIndia's network for daily News Updates, Judgment Summaries, Articles, Forum Threads, Online Law Courses, and MUCH MORE!!"

Tags :Others