Introduced in 1961, the Income Tax Act is the statute under which all taxation-related matters in India are listed. Various tax saving schemes in India, covered undervarious tax-saving Sections [including 80C, 80D, and 10(10D)], are all part of the Act.

Furthermore, the Income Tax Act includes the various Income tax slab rates and associated legislature regarding other administration, collection and recovery norms of income tax. In 2013, the Finance Act inserted Section 87A into the Income Tax Act, to provide tax saving benefits to individual taxpayers.

Under Section 87A, taxpayers can avail rebate that provides for lower tax payment if their annual earnings are below a specified limit. Let us look at Section 87A and its various aspects alongside different tax saving schemes in India that can help you lower your tax liability.

What does Section 87A Say?

According to the directives given by the Income Tax Department, in case you are residing in India, and earns a total income of up to Rs. 3,50,000, is entitled to claim tax rebate under Section 87A. The rebate under the Section is available in the form of deductions from the tax liability. Furthermore, the rebate available under Section 87A will be the lower of 100 percent of the income tax liability of Rs. 2,500.

In simple words, if your total tax liability exceeds Rs. 2,500after creating the best tax saving plan for yourself, you can avail rebate up to the extent of Rs. 2,500 only, while no rebate is available if your total taxable income is more than Rs. 3,50,000.

For the financial year 2019-20, in case your taxable income is upto Rs. 5,00,000, or can bring it down through various tax saving schemes in India; you would not have to pay any taxes as per tax rebate benefits under Section 87A.

What Are the Important Points Under Section 87A?

• The total amount of deduction available under the Section is either 100 percent of your income tax liability or Rs. 2,500 (whichever is lesser)

• The tax deduction applies to the total tax liability before adding the 4 percent educational cess

• Both salaried and self-employed individual taxpayers can avail the tax deduction under the Section

• Senior citizens, between the ages 60 to 80 years are eligible to claim a rebate

• Super senior citizens, ageing 80 years or more are not eligible to claim deduction under Section 87A

• Only Indian residents can claim the refund under Section 87A

What are the Key Aspects of Income Tax Deduction under Section 87A?

• Only Residents of India can avail the deduction

At the time of filing for a tax deduction under Section 87A, you will have to present an Aadhaar card and a birth certificate to prove your citizenship. However, if you are a non-resident, you are ineligible to apply for a rebate under Section 87A.

• Both Male and Female Taxpayers are Eligible for Rebates

Irrespective of their gender, taxpayers can apply for a rebate if their annual income falls under the specified bracket.

• Tax Rebate is Applicable If Your Income Doesn't Exceed Rs. 3,50,000

IIf you are earning up to Rs. 3,50,000 in a given financial year, you are eligible to claim deductions under Section 87A. This rebate can be up to Rs. 2,500 and is applied before adding Education Cess. Furthermore, if your total taxable income is between Rs. 3.50 lakhs to Rs. 5 lakhs, you can claim up to Rs. 5,000 as rebate under Section 87A.

• Citizens Above 60 Years of Age Cannot Avail Deductions

Resident individuals in India, ageing 60 years or above (super senior citizens),are not eligible to claim tax rebate under Section 87. However, the good news is that the income tax rates for AY 2018-19 onwards for senior citizens has been increased to Rs. 50,000 per year, from Rs. 10,000.

How to Claim Deduction Under Section 87A?

To maximize the benefits of having the best tax saving plan, you can avail of the tax rebate under Section 87A as a resident individual whose total net income is below Rs. 3,50,000. Therefore, you may claim up to either Rs. 2,500 or 100% of the income tax, whichever is a lower amount. As a taxpayer, you can claim the rebate at the time of ITR filing tax returns, before including education cess, secondary and higher education cess.

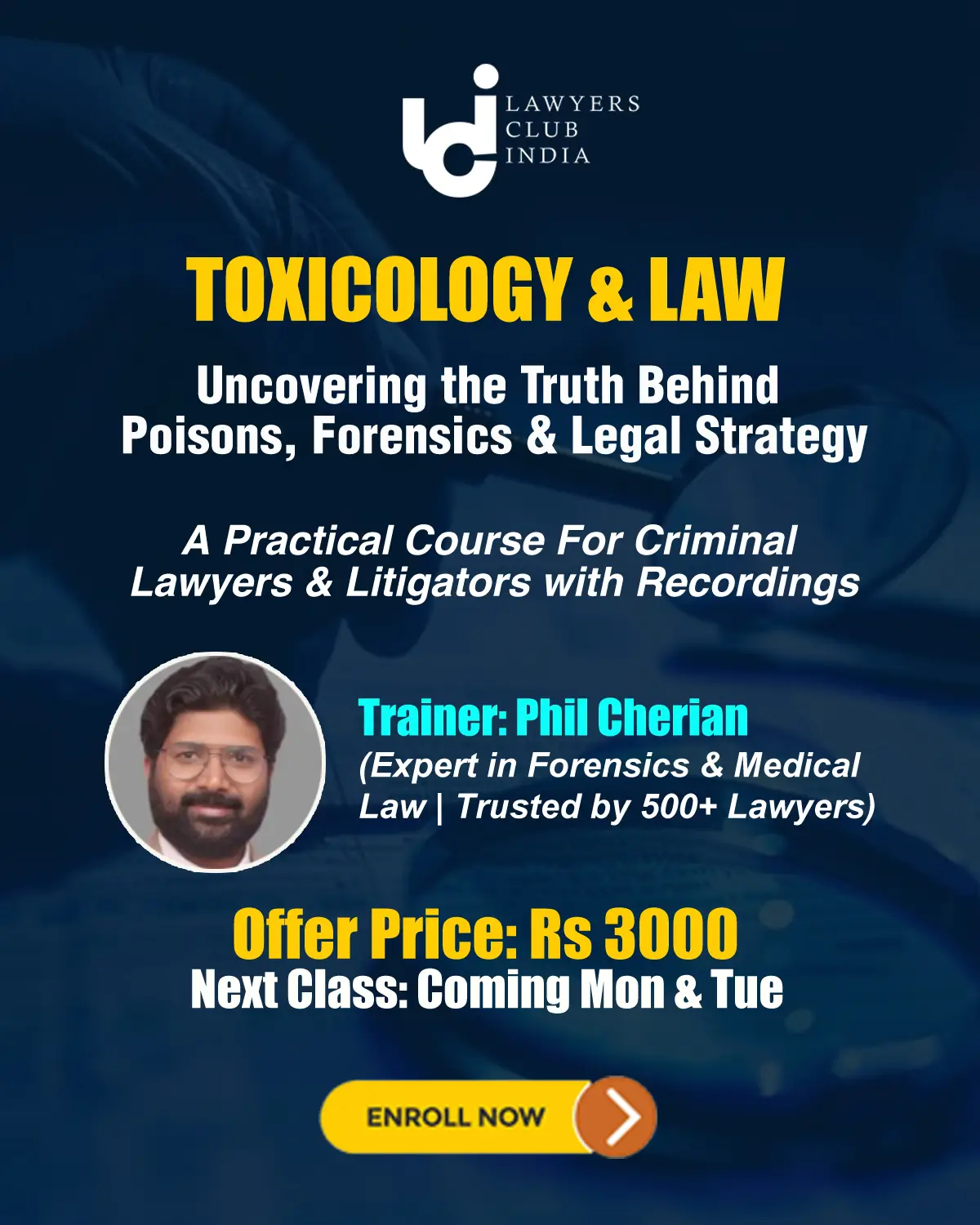

Join LAWyersClubIndia's network for daily News Updates, Judgment Summaries, Articles, Forum Threads, Online Law Courses, and MUCH MORE!!"

Tags :taxation