Consumer Protection & Law - A General Study From India's Perspective By Subhojyoti Acharya THE CONSUMER PROTECTION ACT, 1986, a basic focus- The Consumer Protection Act, 1986 (68 of 1986) is a milestone in the history of socio-economic legislation in the country. The main objective of the new law is to provide for the better protection of the consumers unlike existing laws, which are punitive or preventive in nature. The Act intends to provide simple, speedy & inexpensive redresses to the consumer's grievances. In India various Acts intended to protect the consumers against different forms of exploitation were enacted, such as, the Indian Penal Code, I860; Indian Contract Act, 1872; Drugs Control Act, 1950; Industries (Development and Regulation) Act, 1951; Indian Standards Institution (certification marks) Act, 1952; Drug and Magic Remedies (Objectionable Advertisement) Acts, 1954; Prevention of Food Adulteration Act, 1954; Essential commodities Act, 1955; Trade and Merchandise Marks Act, 1958; Hire purchase Act, 1972; Cigarettes (Regulation of Production, Supply and Distribution) Act, 1975; Prevention of Black marketing and Maintenance of Supplies of Essential Commodities Act, 1980: Essential commodities (Special Provisions) Act, 1981; Multi-State Cooperative Societies Act, 1984; Standard of Weights and Measures (Enforcement) Act, 1985; and Narcotic Drugs and Psychotropic Substances Act, 1985. Some significant consumer protection enactments of pre-independence time are the Sale of Goods Act, 1930; Agriculture Produce (Grading and Marketing) Act, 1837 and Drugs and Cosmetics Act, 1940. The Consumer Protection Act is an alternative and cheapest remedy already available to the aggrieved persons/consumers by way of civil suit. In the complaint/appeal/petition submitted under the Act, a consumer is not required to pay any court fees or even process fee. Proceedings are summary in nature and endeavor is made to grant relief to the parties in the quickest possible time keeping in mind the spirit of the Act, which provides for disposal of the cases within possible time schedule prescribed under the Act. Who is a Consumer? A consumer is any person who buys any goods for a consideration and user of such goods where the use is with the approval of a buyer, any person who hires/avails of any service for a consideration & any beneficiary of such services, where such services are availed of with the approval of the person hiring the service. The consumer need not have made full payment. Goods mean any movable property and also include share, but do not include any actionable claims. Service of any description is covered under C.P.Act & includes Banking, financing, insurance, transport, processing, housing, construction, supply of electrical energy, entertainment, amusement, board and lodging, among others. Who can file a complaint? A complaint on a plain paper either handwritten or typed, can be filed by a consumer, a registered consumer organization, central or State Government & one or more consumers, where there are numerous consumers having the same interest. No stamp or court fee is needed. Consumers can make complaints against which of the things? A) Any unfair trade practice or restrictive trade practice adopted by the trader. B) Defective goods. C) Deficiency in service. D) Excess price charged by the trader. E) Unlawful goods sale, which is hazardous to life and safety when used. Where to file a complaint? The Consumer Protection Act has provided for a three tier system popularly known as "Consumer Courts" :- A) District Forum: For claims up to Rs.20 lakhs. B) State Commission: For claims above Rs.20 lakhs but less than Rs.1 crore. C) National Commission: For claims above Rs. 1 crore. The nature of complaint must be clearly mentioned as well as the relief sought by the consumer. It must be filed in quadruplicate in District Forum or State Commission (as the case may be) if there is only one opposite party. Otherwise, additional copies are required to be filed. Generally complaint should be decided within 90 days from the date of notice issued to the opposite party. Where a sample of any goods is required to be tested, a complaint is required to be disposed off within 150 days. What are the reliefs available to consumers? Consumer courts may grant one or more of the following reliefs:- A) Repair of defective goods. B) Replacement of defective goods. C) Refund of price paid for the defective goods or service. D) Removal of deficiency in service. E) Refund of extra money charge. F) Withdrawal of goods hazardous to life and safety. G) Compensation for the loss or injury suffered by the consumer due to negligence of the opposite party. H) Adequate cost of filing and pursuing the complaint. I) Grant of punitive damages. What Is The Legislation That Ensures All These Rights? It is the Consumer Protection Act, 1986. The act seeks to promote and protects the interest of consumers against deficiencies and defects in goods or services. It also seeks to secure the rights of a consumer against unfair or restrictive trade practices, which may be practiced by manufacturers and traders. There are various levels of ad judicatory authorities that are set up under the Act, which provide a forum for consumers to seek redressal of their grievances in an effective and simple manner. What Are The Other Advantages To The Consumer Under This Law? The consumer under this law is not required to deposit advalorem court fees, which earlier used to deter consumers from approaching the Courts. The rigors of court procedures have been dispensed with and replaced with simple procedures as compared to the normal courts, which helps in quicker redressal of grievances. The provisions of the Act are compensatory in nature. So we can see that The Act has come as a panacea for consumers all over the country and has assumed the shape of practically the most important legislation enacted in the country during the last few years. It has become the vehicle for enabling people to secure speedy and in-expensive redressal of their grievances. With the enactment of this law, consumers now feel that they are in a position to declare "sellers be aware" whereas previously the consumers were at the receiving end and generally told "buyers be aware".

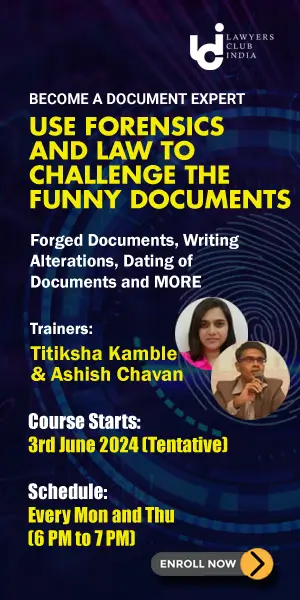

Join LAWyersClubIndia's network for daily News Updates, Judgment Summaries, Articles, Forum Threads, Online Law Courses, and MUCH MORE!!"

Tags :Civil Law