Coverage of this article

SYNOPSIS:

-On the demise of a person it is expected that his estate will be distributed among the surviving family members.

INTRODUCTION:

-The term ‘succession’ is derived from a Latin word ‘successionem’, which means to hold another’s place.

LEGALITY OF THE SUCCESSION CERTIFICATE

-The principle of succession certificate to be valid and binding on all should be known and authorized by the law.

STATUS AND RELEVANCE OF THE CERTIFICATE:

- Has the entire title, claim and interest of the property of the deceased and assets reposed in him unless a superior claim is advanced in the contest of such title.

WHERE TO APPLY FOR?

-An application for the issuance of a succession certificate is to be made in the Civil Court in India, while under some jurisdictions such an application can be made to the Probate Registrar of the High Court, at the first instance before proceeding to the Court.

WHAT SHOULD THE PETITION CONTAIN?

-As encapsulated in the provisions of Succession Act of India, 1925, under Section 372, an applicant must be by the way of petition and shall be made to District Court Judge or the High Court Judge.

WHAT IS THE PROCEDURE FOR OBTAINING THE CERTIFICATE?

-Firstly the petitioner has to file an application containing all the above mentioned details.

WHERE AND FOR HOW LONG IS THE SUCCESSION CERTIFICATE VALID?

-A Succession Certificate is subsisting and valid throughout the country as upheld in Section 380 of the Indian Succession Act, 1925.

CONCLUSION:

-The Succession Laws in India regulate the rules of property devolution in those cases, wherein a person dies without making a will with respect to the transfer of his/her property in the name of his/her legal heirs.

SYNOPSIS:

On the demise of a person it is expected that his estate will be distributed among the surviving family members. The mode of distribution of the estate of the deceased person is dependant on the status of his estate at the time of the death. If a person dies without making a Will or stating how his estate will be distributed on his demise, it is said that the deceased died intestate and his estate has fallen to intestacy. In a situation where the deceased has made a Will but subsequently acquired more estates which were not included in the Will, the properties acquired then would fall to intestacy. Unlike where the deceased made a Will. In case of intestacy, the beneficiaries and the dependents of the deceased must obtain a Succession Certificate before they are allowed to meddle with the estate of the deceased. The following article deals with all the details in regard with the Succession Certificate; it’s legality, status and relevance, where and how to apply, the documents required and the validity of the Succession Certificate.

INTRODUCTION:

The term ‘succession’ is derived from a Latin word ‘successionem’, which means to hold another’s place. The India Succession Act, 1925, aims to consolidate all Indian Laws with respect to succession. The Act has introduced the concept of Succession Certificate in order to resolve disputes regarding the property of the one who died without leaving a will to determine the next legal heir, to acquire the said property and settle the debts and securities due.

Succession Certificate is a document issued by a Civil Court to the legal heirs of deceased person certifying a rightful person to be the successor of the deceased and grants such a certificate, entitling the grantee thereof only to collect the debts and securities of the deceased and imposes an obligation on the grantee to thereafter distribute the same amongst the heirs of the deceased. It is a mandatory procedure that is required to be followed in intestate cases.

The certificate has to mention the list of securities, debt and assets of the deceased alongside the details of the surviving legal heirs and information regarding the death of the deceased.

LEGALITY OF THE SUCCESSION CERTIFICATE

The principle of succession certificate to be valid and binding on all should be known and authorized by the law. The same is authorized and validated by the Succession Act of India and the Hindu Succession Act for Hindus in India. These Acts govern the procedure and lay down the mandatory requirements for Succession in India.

The Succession Certificate can be obtained for both movable and immovable properties, and that too both to a major and a minor. A minor can obtain a succession certificate through a guardian or a next friend.

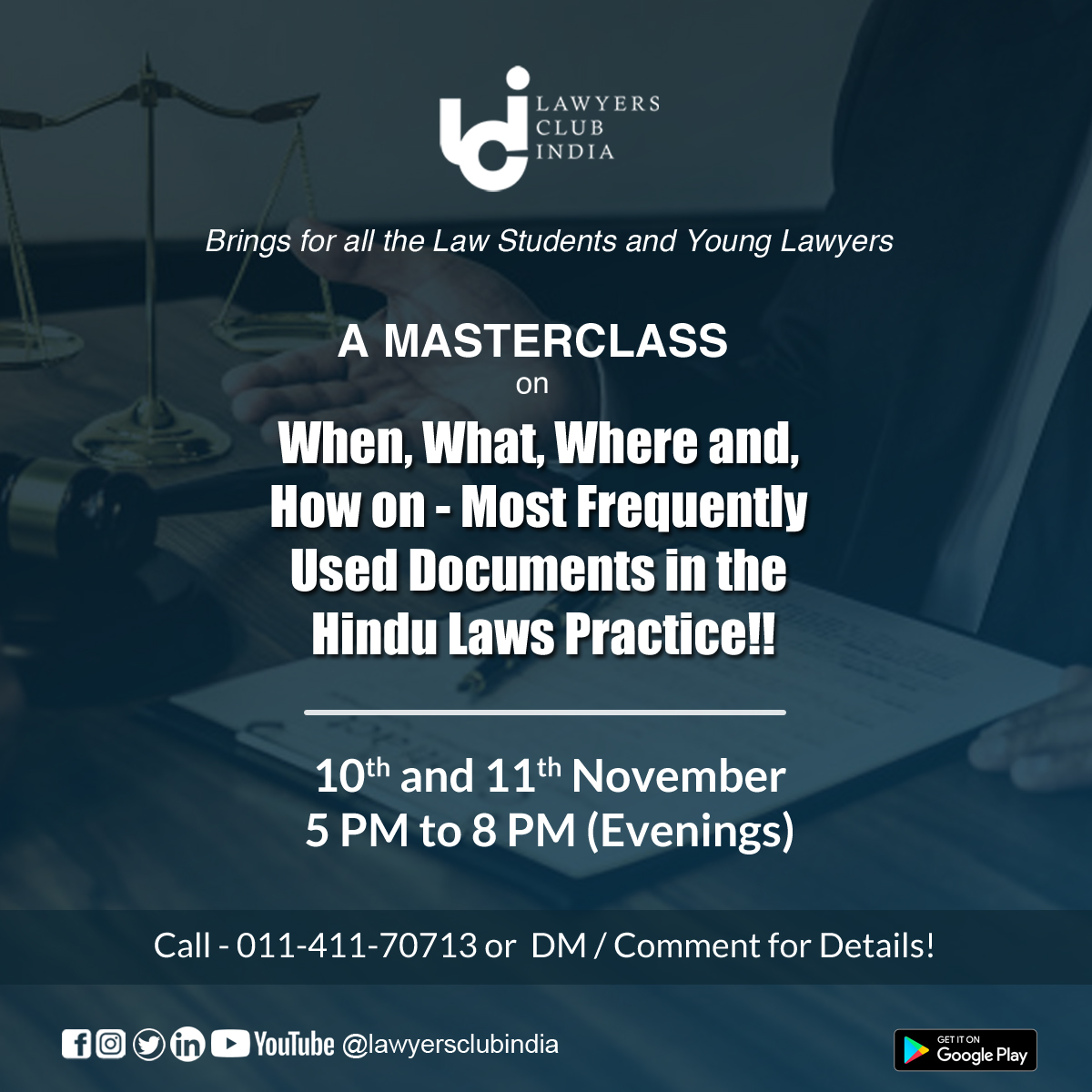

Click here to enroll: Master Class On The Most Frequent Documents-Hindu Laws Practice by Sr. Advocate Guru Gyan Shankar Shukla!

STATUS AND RELEVANCE OF THE CERTIFICATE:

The person who is the bonafide holder of a Succession Certificate, such person:

• Has the entire title, claim and interest of the property of the deceased and assets reposed in him unless a superior claim is advanced in the contest of such title.

• Has the unfettered power too, in the name of the deceased, can collect debts and securities due or has to pay the playable in his name. The doctrine of privity of the contract shall not operate to vitiate this power unless where the claim pertains to a personal right of the deceased which does not outlive the deceased.

• While enjoying the rights and privileges the debts and other existing liabilities of the deceased are vested along.

WHERE TO APPLY FOR?

An application for the issuance of a succession certificate is to be made in the Civil Court in India, while under some jurisdictions such an application can be made to the Probate Registrar of the High Court, at the first instance before proceeding to the Court. A Civil Court is empowered with the powers to order the grant of Succession Certificate in India. It can be a District Court or a High Court of Justice, depending upon the value and location of the property and assets. In case of Jurisdiction, it is the District or the High Court, where the deceased resided as opposed to where the heir (applicant) resides. Alternatively, such application, for the grant of succession certificate, can be filed where the properties of the deceased are situated. This is in line with the doctrine of lex domicile and lex situs which guides the administration of the estate of the deceased person.

WHAT SHOULD THE PETITION CONTAIN?

As encapsulated in the provisions of Succession Act of India, 1925, under Section 372, an applicant must be by the way of petition and shall be made to District Court Judge or the High Court Judge. The petition must be signed by the petitioner (the person praying the Court to grant the certificate in his favor) or some on his behalf may sign (mostly a legal practitioner acting on the petitioner’s behalf). The particulars to be specified in a petition regarding the Succession Certificate are specified in the above mentioned Act, and every application is required to be signed and verified in accordance with the provisions of Code of Civil Procedure, 1908 applicable to plaints.

In addition the petition should contain:

• Complete details regarding the date and time of the death along with the copy of the death certificate, proof of ordinary residence of the deceased. If no such information is available, then the details of his property that is within the jurisdiction where the application has been filed.

• Details regarding residence of the legal heirs along with other basic information of the same with attached copies of their ration card.

• Information regarding family and other next kin of the deceased, along with their residence..

• The debt and security in respect of which the certificate is applied for

• The petitioner must state the circumstances under which his/her rights over the estate of the deceased emanated

• In case of absence of any reason to invalidate the certificate, a declaration of the same has to be made.

Along with these two documents must be presented or annexed with the petition. The documents are:

1. Death Certificate of the deceased person

2. No Objection Certificate (NOC) of consent from other legal heirs (if any).

WHAT IS THE PROCEDURE FOR OBTAINING THE CERTIFICATE?

Firstly the petitioner has to file an application containing all the above mentioned details. The application has to be verified, signed and then has to be submitted to the District Judge, having appropriate jurisdiction along with the prescribed Court Fees as per the Court Fees Act, 1870.

On presentation of such a petition the Court shall scrutinize the application and if satisfied shall admit the same. The Court would then cause a notice to be issued and served to all legal-heirs in order to enable them to file objections if any in regard of granting of the succession certificate on to the heir-applicants.

The also issues a notice, which is to be published in a news paper, to the effect that the specified period of rising an objection is 45-days. In the absence of objections from the heirs served with the notice, the petition shall be upheld and a Succession Certificate shall be issued on the heir-applicant. If there are any objections raised, the Court would hear them and decided on the same.

On completion of the hearing of the case, the Judge will decide whether the applicant has the appropriate right to apply for the application of the succession certificate. If the judge is satisfied with the petitioner, then he may issue the certificate attached with a court fee which shall levy a fixed percentage with specification regarding the debts and securities in the application. The certificate shall also acknowledge the rights and powers granted to the applicant with respect to receive interest or dividends on securities or transfer or negation securities. It shall also set forth the debt and security. The grant of certificate is conclusive against the debtor. It shall not be held invalid even in case another person appears as the heir of the deceased.

An indemnity bond to secure the entitled person shall be required to made and submitted to the Judge. A surety or some kind of security may also be attached. This is required in order to secure assets and prevent any loss or make good of any possible damages which may occur out of the usage of such a certificate. The holder of the Succession Certificate shall then proceed to claim every right and benefit from the estate of the deceased in accordance with the said Act.

A Succession Certificate shall be refused in a situation where obtaining a grant of Probate is necessary. Alongside, any false declaration made by the heir-applicant may ground a conviction after investigation and trail in a court of competent jurisdiction for an offence under IPC.

Note: The district Judge may also grant an extension in respect of any debt or security which was not included in the earlier application.

|

Fun Fact? When there are more than one application for the certificate, the judge will decide whom to issue the certificate on the basis of the interest of the applicants and other such reasons. |

WHERE AND FOR HOW LONG IS THE SUCCESSION CERTIFICATE VALID?

A Succession Certificate is subsisting and valid throughout the country as upheld in Section 380 of the Indian Succession Act, 1925. Every person and authority in India has to accord recognition to it. In the case where an NRI or Foreign National is granted the certificate, the certificate would be valid only if it is duly stamped and certified. The grant and issuance of the Succession Certificate is a time taking legal adventure but where the petition is not contested the Court is obliged in the absence of any obvious defect in the legal processes filed, to issue a Succession Certificate within Seven Months of such an application. The succession certificate can extend to movable and immovable properties of the deceased.

The Succession Certificate once issued cannot be contested again or revoked. But if the issuance is made in the absence of jurisdiction or by fraud it can be set aside at the instance of the aggrieved party by making a proper application to the Court to set the same aside. The application has to be in the exercise of the right to appeal against the order.

CONCLUSION:

The Succession Laws in India regulate the rules of property devolution in those cases, wherein a person dies without making a will with respect to the transfer of his/her property in the name of his/her legal heirs. The rules help to determine as to who would receive the property of the deceased and the percentage of transfer. Like if the deceased is left with two legal heirs behind, the property would be divided among the legal heir equally irrespective of their gender. The Succession Certificate acts as an authentic document which guarantees that the person awarded with the Succession Certificate if the legitimate owner of the property of the deceased. It also helps to secure the heir from the loss of debt or security which was due on the deceased, by transfer of such to the legal heir by the Succession Certificate.

Join LAWyersClubIndia's network for daily News Updates, Judgment Summaries, Articles, Forum Threads, Online Law Courses, and MUCH MORE!!"

Tags :legal documents