If you are interested in investing your money in mutual fund investments, it is essential for you to understand taxation post Union Budget, 2018. The finance minister, Mr. Arun Jaitley has announced the following two taxation changes related to equity investments:

- 10% dividend distribution tax will be levied on the dividend option of equity funds

- Reintroduction of long-term capital gain tax on profits. If there will be a profit of more than Rs 1 lakh from the sale of equities, there will be a long-term capital gain tax of 10%

So, does it mean, you should avoid investing in mutual funds and look for an alternative investment option that invests your money in a growth-oriented fund? The answer is No.

Here are important things that you should know to make your mutual fund investments both tax-friendly and financially viable.

Factors Impacting the Taxation of Mutual Fund Investments

Before worrying over taxation, it is essential to understand that your tax outgo depends on the factors like:

- Type of mutual fund investment: A fund which invests 65% or higher in equity falls under the equity fund category. Other funds with less than 65% equity component are debt funds. On the basis of the nature of the fund, taxation is done.

- Holding Period: In equity funds, a tenure less than one year is a short term. In debt funds, any investments for less than three years are short-term, and thus, tax rates are applicable accordingly.

- Residential Status: Taxation rate is different for both resident Indians and non-resident Indians (NRIs).

How Is Long-term capital gain (LTCG) Tax Levied on Mutual Fund Investments?

There is a tax rate of 10% if there is a gain of more than Rs 1 lakh on the selling of stocks or equity after January 31, 2018. It is not a retrospective tax and therefore, gains earned before January 31, 2018, will remain tax-free.

Let's understand how long-term capital gain is taxable.

Let's assume; you had invested Rs 2 lakh in equity mutual funds one year ago. You sell these funds after 1st April 2018 for Rs 2.2 lakh after holding them for one year from the date of purchase. To calculate your long-term capital gains, you must check the value of your holdings on 31st January 2018. If we assume, the value as Rs 1.5 lakh, then your long-term capital gains will be Rs 70,000 (Rs 2.2 lakh-1.5 lakh).

Reiterating, you must calculate the value of your holdings as of 31st January 2018 instead of considering the original purchase price. As the above amount is less than Rs 1 lakh, it will remain tax-free.

How is Dividend Distribution Tax (DDT)Imposed?

Earlier, there was no dividend distribution tax on mutual fund investments with a dividend option. The amount received as a dividend by the investor was tax exempted. However, post-budget 2018, 10% DDT will be applicable to every equity investor.

This tax should not be a big issue if you invest in equity funds for a long-term and stay away from dividends. Receiving dividends are of no use as it liquidates the money instead of allowing it to grow.

How is Security Transaction Tax (STT) Levied?

In case of the sale of equity-oriented mutual funds, 0.001% STT is levied by the mutual fund company. There is no change in STT post budget. It means it will continue to remain same for all equity-oriented mutual funds.

Now which option to choose: Growth, Reinvestment of Dividend or Dividend Payout?

Your choice between growth and dividend should depend on how long you prefer to stay invested and what is your present tax rate. In case of any doubt, go with the following rule:

Go with payout option only if you need a regular source of income. Otherwise, choose the growth option. In the long run, the reinvestment of dividends can grow manifold.

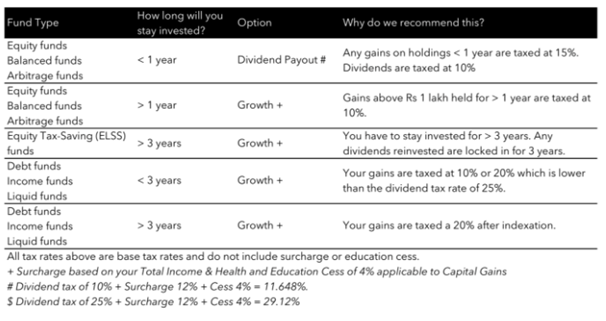

The table below will help you understand how you should choose between growth and dividend for your investments.

Growth or Dividend?

(Considering your current tax rate as 10% or 20%.)

Source: Clearfunds and MoneyControl

No Need to Press The Panic Button

Despite the introduction of the long-term capital gain tax, equity mutual funds should remain the viable investment option for the long-term growth of your money. Returns would offset the impact of tax. So, stay invested in equity funds to accomplish your long-term goals, like a child's education, marriage, retirement, etc.

About the author:

Varsha Channa grew up in Delhi, India and graduated from the University of Delhi. She has been a keen Finance blogger from 5 years. She likes to read and learn about Finance through various ways.

Join LAWyersClubIndia's network for daily News Updates, Judgment Summaries, Articles, Forum Threads, Online Law Courses, and MUCH MORE!!"

Tags :Others