INTRODUCTION

Gender Equality is one of the basic principles of the Indian Constitution and in order to remove inequalities between men and women with respect to the rights in property the Hindu Succession Act lays down the rules and a common list of heirs entitled to succeed the property.

Hence there was a need to form a uniform set of law for inheritance which may be acceptable to all the sections of Hindus and which can be equally enforceable on them. In this article we shall discuss about the laws governing inheritance of different Hindu family members.

1.WHAT IS INHERITANCE?

When a person dies without leaving or making a will he or she is called as ‘intestate’. It is for this purpose that the law of inheritance determines the persons who will take the property.

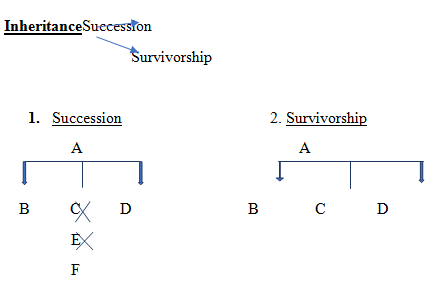

The law of inheritance is determined under 2 heads :

The Law of Succession is classified as under :

- Testamentary Succession

- Intestate Succession

- Testamentary Succession - The law of Testamentary Succession is concerned with the rules relating to making of a will.

- Intestate Succession - The Intestate Succession deals with the matters such as who are the persons entitled to take the property i.e. heirs, rules of preference, the manner in which the property is to be distributed in cases where a person has more than one heir and also the qualifications and disqualification of heirs.

The main distinction between the terms ‘Succession’ and ‘Inheritance’ is :

- The law of intestate succession is more properly the law of inheritance. The law of inheritance consists of rules which determine the mode of devolution of the property of the deceased ‘solely on heirs’ on the basis of their relationship with the deceased.

- While the law of Testamentary Succession deals with the rules relating to devolution of property on ‘relations as well as others’. Succession opens at the time of the death of the person whose estate is in question and is governed by the law in force for Succession of property.

- 2 Systems of Inheritance among Hindus

According to the Hindu Succession Act, 1956 there are 2 systems of inheritance amongst the Hindus in India -

A. Mitakshara System - This system recognizes 2 ways of devolution of the property namely : 1) Devolution by Survivorship & 2) Devolution by Succession.

B. Dayabhag System - This system only recognizes one mode of devolution i.e. by way of Succession.

2. HINDU MALE SUCCESSION

Sections 8 to 13 of the Hindu Succession Act deals with Hindu Male Intestate Succession. This section applies to intestate property only. According to section 8 of this act when a male dies intestate i.e. without any will or testament his property shall devolve :

1St - Upon Class I heirs

2nd - Upon Class II heirs ( In the absence of Class I heirs)

3rd - Upon Agnates ( In the absence of Class I & Class II heirs)

4th - Upon Cognate ( In the absence of agnates)

1. Son

a. Natural

b. Adopted

c. Posthumous

d. Illegitimate (conceived)

2. Daughter

a. Natural

b. Adopted

c. Posthumous

d. Married / Unmarried

e. Illegitimate

3. Widow

a. Not more than one

b. Should be valid marriage

4. Mother

a. Adoptive

b. Natural

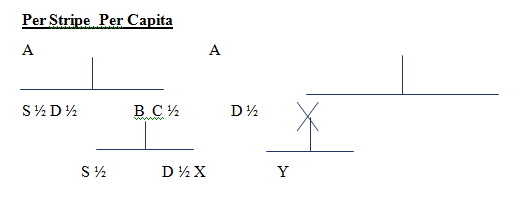

With regards to Class I heirs, their shares are not equal and these shares are determined as per the rules laid down under section 10. There are 4 rules as follows: Rule 1 : The intestate’s widow shall take 1 share.

Rule 2 : The surviving sons, daughters and mother shall take 1 share each.

Rule 3 : The heirs of each pre-deceased son or daughter of the intestate shall take 1 share.

Also if there are 2 or more heirs of the intestate they shall inherit the property according to ‘Per Capita' and not ‘Per Stripe'.

• Class II heirs ( 9 Categories)

1st Category - Father

2nd Category - a. Son's Daughter’s Son (SDS)

b. Son’s Daughter’s Daughter (SDD)

c. Brother [ Uterine not included ]

d. Sister

3rd Category - a. Daughter’s Son’s Son (DDS)

b. Daughter’s Son’s Daughter (DSD)

c. Daughter’s Daughter’s Son (DDS)

d. Daughter’s Daughter’s Daughter (DDD)

4th Category - Nephew & Niece

5th Category - Paternal Grand Parents

6th Category - a. Father’s Widow

b. Brother’s Widow

7th Category - Paternal Uncle & Aunt

8th Category - Maternal Grand Parents

9th Category - Maternal Uncle & Aunt

- Agnate

A person is said to be an agnate when he is related to the deceased wholly through male link or relation by blood / by adoption. Example - Son’s Son’s Son, Father’s Brother’s son, Brother’s Son’s son.

- Cognate

A person is said to be a cognate when he or she is related wholly through the female link either by blood / by adoption. Example - Daughter’s Son, Son’s Daughter’s Son.

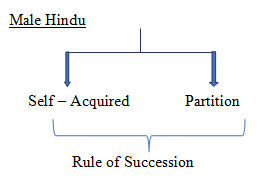

The term ‘property’ in this section not only includes separate or self acquired property but also his interest in coparcenary property after partition.

1. Adopted Son

If a widow of a coparcener adopted a son after the partition, the adopted son becomes entitled to re-open the partition to claim his share in the property. He gets all the rights like that of a naturally born son.

2. Son in Womb

At the time of partition, if a son is in the womb and no share is reserved for him he can get the partition reopened.

3. Son conceived and Born after Partition

Where a father does not take share at the time of partition and a son is begotten and born to him, the son van reopen the partition.

4. Illegitimate Son

The illegitimate son of a male Hindu dying intestate is not entitled to any share by inheritance. An illegitimate son cannot ask for partition but is entitled to claim only on the death of his father, if he survives as a coparcener along with the legitimate son.

5. Son, Grandson or Great Grandson

According to Mitakshara System they have a right while partition. But they do not have any right in partition according to dayabhag system.

6. Step Son

In case of death of the mother her property would be inherited by her son not the step son.

7. Posthumous Son

A Posthumous son i.e. the son of the intestate who was in the womb at the time of death of the intestate and is born alive subsequently, he will be deemed to have born before the death of the intestate for the purpose of succession.

8. Son of a Pre-deceased Son

The son of a pre-deceased son inherits simultaneously like other heirs mentioned in class I.

9. Son of a Pre-deceased Daughter

The son of a pre-deceased daughter inherits the property of the male Hindu who dies intestate. Daughter’s Son will include an adopted son

10. Minor

A minor coparcener can claim inheritance in joint family property. There is no bar to claim partition.

3. HINDU FEMALE SUCCESSION

Section 15 of the Act lays down the ‘General rules of Succession’ in cases of a female dying intestate and Section 16 provides for the ‘Order of Succession’ and manner of distribution among heirs of a Female Hindu.

Before the passing of the Hindu Succession Act, 1956 the property of a woman was recognized into 2 heads : 1. Stridhan and 2. Women’s property

But now every property in her rightful and valid possession is called as stridhan and which is governed by the rules provided under Sections 15 and 16.

According to section 15 the property of a female Hindu dying intestate shall devolve according to the rule set out under section 16, which are as follows:

- Upon Son, daughter, husband

- Upon Heirs of the husband

- Upon Mother & Father

- Upon Heirs of the Father

- Upon Heirs of the Mother

- A woman acquires property in 3 ways -

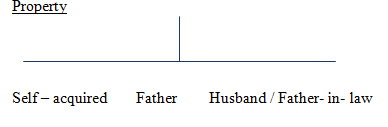

- 2 Exceptions Relating to Principles of Succession

In case of a female Hindu dies intestate and has no living heirs then in that case there are 2 exceptions -

- The property inherited by her from her father or mother will go to the heirs of her father.

- The property inherited by her from her husband or father- in- law will go to the heirs of her husband.

These are the list of Class I heirs (female) under the Hindu Succession Act, 2005 who can or cannot inherit the property when a Hindu Male dies intestate.

- Daughter - The daughter irrespective of whether being married or unmarried inherits simultaneously like other heirs. Each daughter takes 1 share equal to that of the son. Unchastity of a daughter is no ground for exclusion.

- Step- Daughter- A step daughter does not falls within the meaning of daughter as per section 8 of the act as she is not related to the deceased by blood nor she is his descendant. Thus she cannot inherit the property.

- Widow - As a widow is the lawfully wedded wife of the deceased Hindu Male she also inherits the property. If there are more than one widows, all the widows together will take 1 share which they shall equally divide amongst themselves. Grounds like unchastity, conversion or remarriage shall not divest her from the property which she had already inherited from her husband.

- Mother - Mother of a Hindu Male shall also inherit the property. Unchastity or remarriage is no bar to inherit her son’s property. Mother shall also include an adoptive mother. Also a mother can inherit the property of her illegitimate son.

- Step- Mother - A step mother cannot inherit the property of her step son.

- Daughter of a Pre- Deceased Son - Such daughter’s can also inherit the property. Son’s daughter would also include the adopted daughter of the pre- deceased son.

- Daughter of a Pre- deceased Daughter- The daughter of a pre- deceased daughter also has the right to inherit the property. This will also include an adopted daughter of pre- deceased daughter.

- Daughter of a Pre- deceased Son of a Pre- Deceased Son - Such daughter would also inherit the property which shall also include such adopted daughter of a pre-deceased son of a pre-deceased son.

- Second Wife - If she is the legally wedded wife of the Hindu Male who dies intestate then the second wife and her children shall have the right to inherit the property. But in case she is not legally his second wife and the male Hindu who died intestate has first wife who wasn’t divorced nor died then in such cases the 2nd wife cannot inherit the property of the male Hindu nor her children shall inherit the property.

- Abandoned Wife - In cases where the 1st wife is abandoned by her husband without being divorced, then the 1st wife shall be entitled to inherit the property of the Hindu Male who dies intestate.

Join LAWyersClubIndia's network for daily News Updates, Judgment Summaries, Articles, Forum Threads, Online Law Courses, and MUCH MORE!!"

Tags :Others